December 8, 2025

Co-Founder/CEO of Overjet

When Wardah Inam got two different diagnoses from two different dentists, she started asking questions. Why, in an age of precision medicine and advanced imaging, was dental diagnosis still so inconsistent?

The MIT-trained PhD was working in clean energy at the time, nowhere near healthcare. But the experience stuck with her. An engineer by training, she began shadowing dentists, watching how they worked, trying to understand why a field of health that touched nearly everyone still relied so heavily on instinct.

For all the technological progress elsewhere in medicine, dentistry remained stubbornly analog. Two clinicians could look at the same X-ray and reach different conclusions. Patients had no way to verify what they were being told. Insurers and providers fought constantly over what the images actually showed. The whole system ran on interpretation, not data.

Powered by a cultural shift around AI

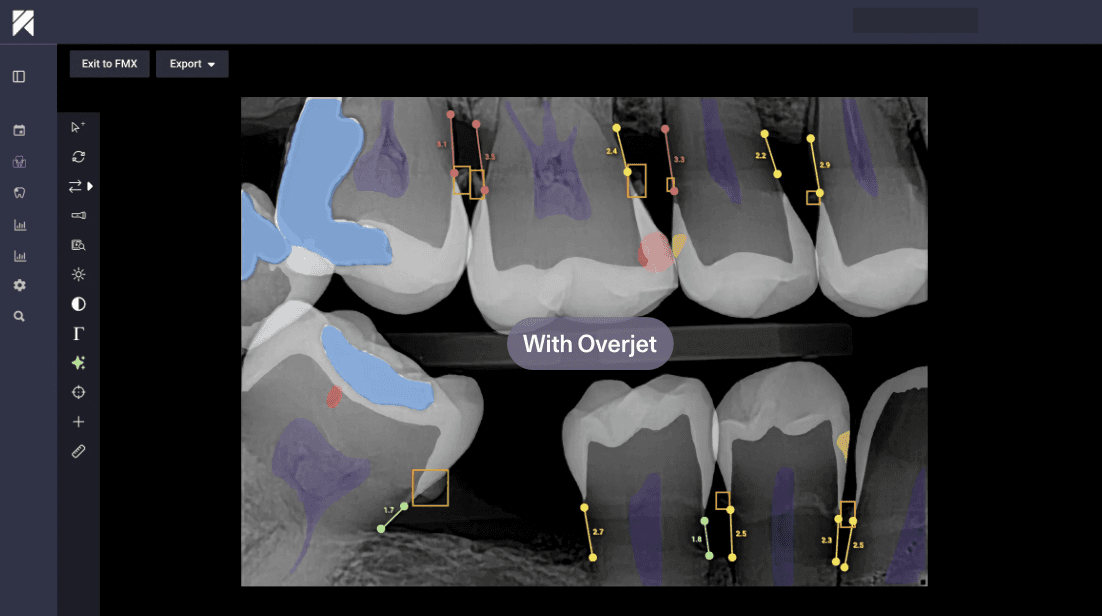

Inam started Overjet with Deepak Ramaswamy, another MIT PhD, to change that. Their idea was simple in theory, hard in practice: use AI to give everyone—dentists, patients, insurers—the same objective view of what's happening in someone's mouth. Quantify bone loss. Flag decay. In essence, turn subjective readings into measurable facts.

Seven years ago, when they began, this sounded like fantasy. AI wasn't part of everyday life. ChatGPT didn't exist. When they demoed early versions of the software to dentists, most assumed it was some kind of trick. They assumed the images had been pre-labeled, that no algorithm could actually read an X-ray cold. Even insurers, who dealt daily with inconsistent claims and endless appeals, were skeptical.

The 2022 release of ChatGPT changed the conversation. Suddenly, the public understood that machines could interpret complex information. Dentists who had dismissed the technology started asking how it worked. Payers who had insisted on manual review wanted to know if AI could speed things up. Unlike other AI-based technologies this cultural shift didn't create Overjet's market, but it removed the friction that had slowed adoption for years.

By then, Overjet had already done the hard work. The company had secured FDA clearance—becoming the first dental AI cleared to detect and quantify both bone loss and decay. It had built relationships with major insurers and dental service organizations. It had spent years collecting clinical data, refining its models, and proving that the technology actually worked across different machines, patient populations, and clinical settings.

Finding stakeholder alignment

Wardah had accomplished rare alignment in an industry defined by conflict. For dentists, Overjet adds clarity and consistency. Color-coded overlays help patients see what the dentist sees. Measurements improve documentation. Practices report higher case acceptance because patients finally understand what's going on and insurers feel confident in diagnoses.

Claims reviewers processing millions of images a year get a standardized view of pathology. Disputes drop. Adjudication speeds up. The adversarial dynamic that has long defined the provider-payer relationship starts to soften.

Building solutions, not moonshots

For years, healthcare investing meant funding moonshots—big bets on technologies that might, eventually, bend the cost curve or improve outcomes. Overjet represents a more grounded thesis that the best opportunities may lie in fixing the mundane inefficiencies hiding in plain sight. Dentistry is a $150 billion market in the U.S. alone, yet it operates on infrastructure that hasn't fundamentally changed in decades.

Healthcare is littered with technologies that worked but never scaled, innovations that couldn't survive the gap between proof of concept and widespread adoption. Overjet's 2024 $53 million Series C, the largest investment ever in dental-tech, reflects productive investment in a company that had already proven it could reduce friction across an entire system.

When Inam talks about Overjet, she talks about giving people better tools, helping clinicians do their jobs, helping patients make informed decisions, and helping insurers process claims fairly. When patients understand their diagnosis, they're more likely to follow through on treatment. When insurers trust the documentation, disputes decline and administrative costs fall.

When dentists spend less time justifying their decisions, they can see more patients. None of this is revolutionary in isolation. But compounded across millions of visits and billions of dollars in claims, the gains add up fast.

The market impact

This is what it looks like when capital flows toward real problems. Not flashy, not overnight riches, but the steady improvement of core products and services. In an era when investors are rethinking what impact means, the company offers a useful model: find the friction, build the fix, and let the returns follow.

What makes Overjet significant is the demonstration that some of healthcare's most persistent problems have tractable solutions. The friction between providers and payers, the confusion patients feel about their own care, the inefficiencies that drain resources without improving outcomes are not unchangeable facts of the system. They're engineering problems waiting for the right approach.

Inam's journey from questioning her own dental diagnosis to building a company that's reshaping an industry reflects a particular kind of entrepreneurship: one that starts with firsthand frustration and ends with infrastructure that works.

In a healthcare landscape often dominated by grand promises and distant timelines, Overjet offers something simpler and more valuable—a solution that's already working, at scale, today.